Finance

India’s new SMS regulation creates havoc for banks, essential services

SMS deliveries have been down for days

Indian telecom service providers started implementing the second phase of a new SMS regulation, disrupting essential services like OTP (one-time passwords), bank updates, and e-commerce messages. This is an industry-wide issue affecting everything, including India’s identity verification program called Aadhaar and the Coronavirus vaccination portal called CoWIN.

The Telecom Regulatory Authority of India (TRAI) recently issued a guideline that mandated verifying every SMS and its content before delivery. The process is technically called scrubbing and was implemented on March 8, 2021. As a result, unverified and unregistered SMS messages were blocked by telcos.

TRAI says that scrubbing helps reduce spam or misleading messages that pretend to be from a financial institution. The process helps in differentiating between promotional and transactional messages. To control fraud, a blockchain-based solution is used by telcos to check every SMS’ header and content. If the source isn’t registered, the message won’t go through.

Telcos say that they simply followed the upgrade regulations and that telemarketers and companies are yet to join the formal registration process. Unfortunately, neither the telcos nor the banks have issued a statement to address public outrage.

Every transaction done by a credit or debit card is authenticated on the spot via a preset PIN or SMS OTP in India. For online transactions, a vast majority of users rely on OTPs, and these just aren’t getting delivered. Even SMS updates about a transaction aren’t able to go through. Telcos pushed back and pinned the blame on companies and their lax adoption, which have failed to comply with regulatory standards.

According to BloombergQuint, Axis Bank, one of India’s largest private banks, can deliver only 25 to 30 percent of the total messages. In the meantime, users are suggested to rely on alternative authentication services like Verified by Visa.

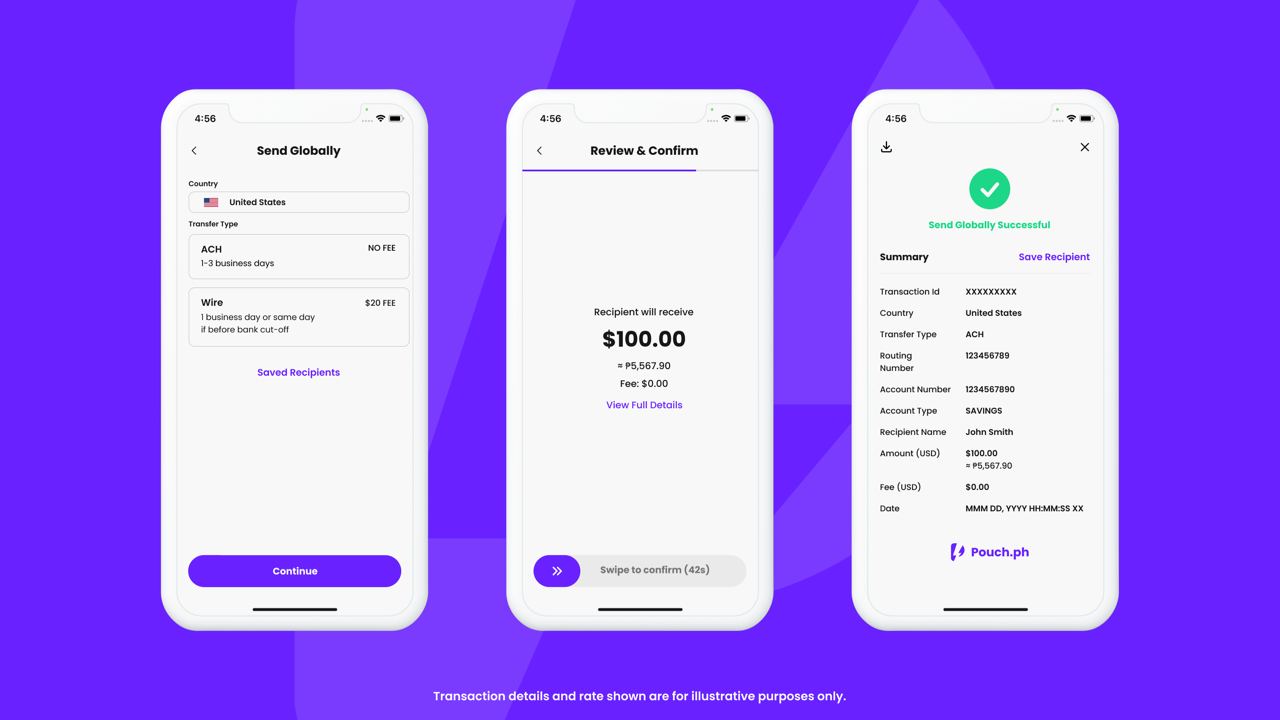

Pouch, a lightning payment app launched in 2021, is introducing its latest feature called Send Globally which will allow users to facilitate money transfers from the Philippines to any bank account in the United States.

Money will be sent in Philippine pesos and will be received in US dollars via the recipient’s bank account.

Both business and individual accounts can use Send Globally to send any amount from US$ 1 to US$ 1,000. In the future, Pouch plans to raise the transaction limit.

To send money via the Pouch app via Send Globally:

- Download the Pouch.ph app and sign up

- Tap “Send Globally”

- Tap “United States”

- Enter the recipient’s name and bank account number

- Enter the amount (in PhP0

- Confirm the exchange rate

- Funds get credited to the US bank account

The startup app is also planning on expanding into more markets by collaborating with more international partners for seamless payment services across the world.

Pouch is downloadable via both the App Store and Google Play.

Thinking of going cashless on you next trip to Europe? GCash can offer just that, as the mobile wallet app is now accepted in the United Kingdom, France, Germany, and Italy.

The cross-border payment service is part of the e-wallet’s strengthened partnership with Alipay+, offering users a seamless and secure payment experience without the need for money changers and carrying to much actual cash on your pockets.

Among the popular merchants that will be accepting GCash from now on are:

- Harrods

- Liberty London

- Harvey Nichols

- Printemps

- Müller

- dm-drogerie markt

- itTaxi

- IVS Group

To pay using GCash at these establishments, travelers will simply have to look for the Alipay+ logo at the checkout.

Open the GCash app, select the QR or PayQR button, scan the merchant’s QR code, or tap “Pay Abroad with Alipay+” to have a generated QR.

Finally, check the amount, and tap Pay to see the receipt.

Following the recent launch of GCash Overseas, the International Buy Load feature is now available on the mobile wallet in 21 countries.

This beta feature will benefit individuals needing to purchase load for their relatives abroad and their international mobile numbers.

The service will be available in the following countries:

- Egypt

- Ghana

- India

- Malaysia

- Mexico

- Nepal

- Nigeria

- Pakistan

- Panama

- Peru

- Singapore

- South Africa

- Spain

- Sri Lanka

- United Arab Emirates

- United Kingdom

- United States of America

- Vietnam

- Yemen

- Zambia

The full launch is expected later this year. Likewise, OFWs in the US can now buy load for themselves or access other services using the GCash app.

GCash is also accessible in other areas like Japan, South Korea, Singapore, Malaysia, United Kingdom, France, Germany, and Italy.

-

Reviews2 weeks ago

Reviews2 weeks agoThe Xiaomi Pad 6 is great for the editor on-the-go

-

Reviews2 weeks ago

Reviews2 weeks agoHONOR 90 review: Simply bedazzling

-

Gaming2 weeks ago

Gaming2 weeks agoRefurbished Steam Decks are now available through Valve

-

Health2 weeks ago

Health2 weeks agoRedmi Watch 3 Active: Basic but better

-

Gaming2 weeks ago

Gaming2 weeks agoRockstar officially partners with Grand Theft Auto V roleplay servers

-

Gaming2 weeks ago

Gaming2 weeks agoPlayStation 5 Slim supposedly leaked online

-

Entertainment2 weeks ago

Entertainment2 weeks agoCatch Cinemalaya 2023 films at Ayala Malls this weekend

-

Apps2 weeks ago

Apps2 weeks agoSpotify DJ feature now available in the Philippines